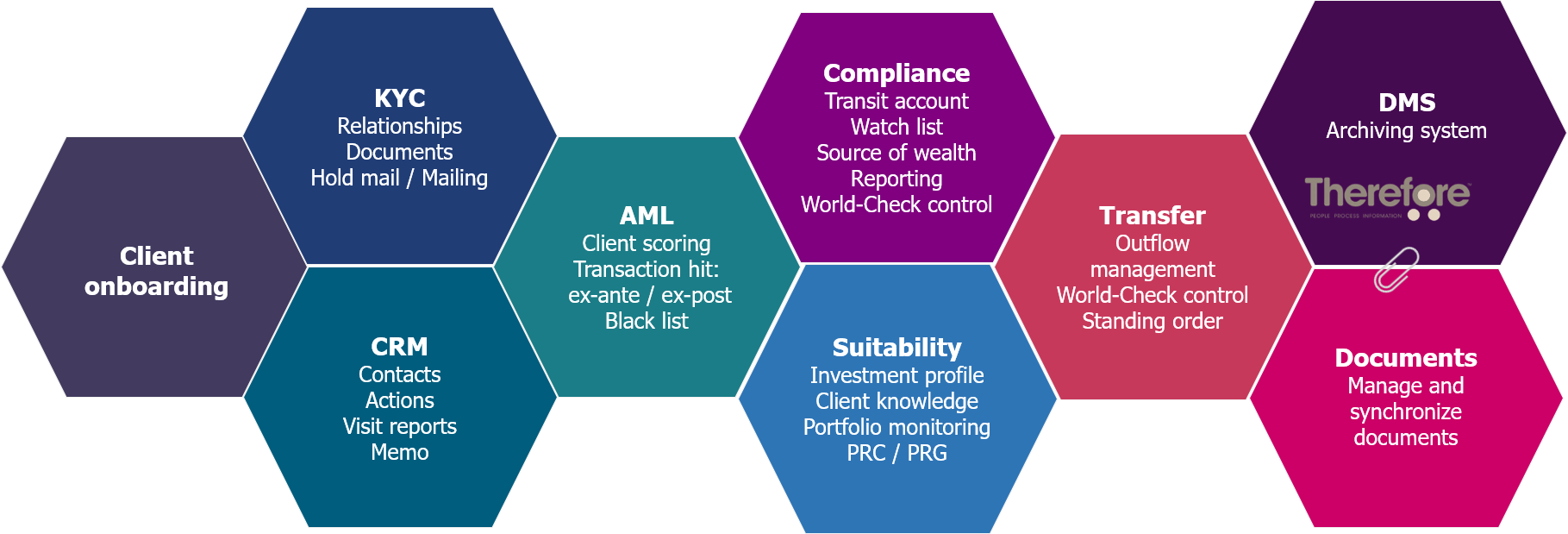

All in one

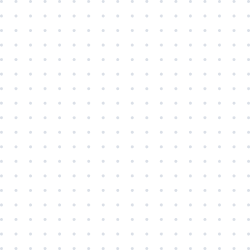

CIF, KYC, CRM, AML, Hit, Visit Report, Action, Fatca, Dow Jones, Client Knowledge, Risk Investment Profile, Blacklist, Campaign, Tax Profile, Suitability, Client On-Boarding on IPad, Digital signature and more

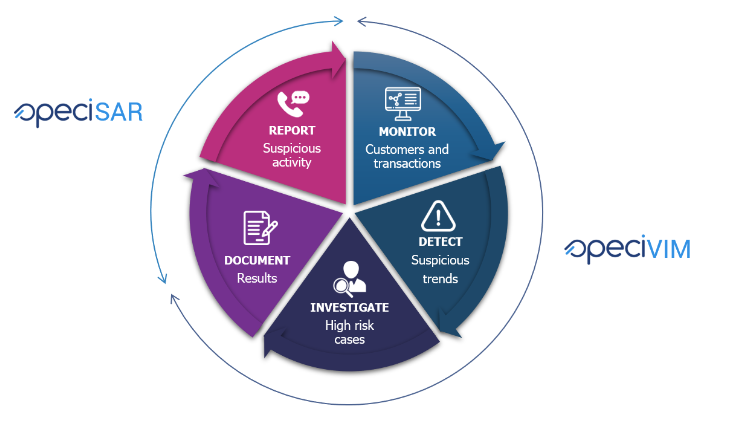

Open

We provide live API on our software in order to fully integrate the solution in your environment

Quick implementation

Easy and efficient, already interfaced with most of the existing core banking