Mortgage Stress Testing with SpeciCRED

As central banks keep raising interest rates and some parts of the Real Estate market slow down, it’s crucial to stress-test portfolios with mortgages using new criteria.

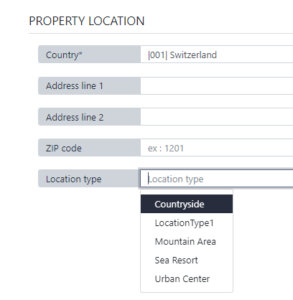

#SpeciCRED has improved its mortgage system by adding new features related to properties. One of these new features is the ‘property location type.’ It helps categorize properties based on where they are, like urban areas, beachfronts, commercial zones, mountains, or the countryside.

With these upgrades, you can predict how your investments might be affected in different property locations if the real estate market declines. Stress-testing property values lets you plan ahead and handle potential problems proactively.

These improvements are part of SpeciCRED’s ongoing effort to enhance its Lombard monitoring solution, providing you with better tools for managing your investments.